Quicken Financial Life For Mac

If you're looking to replace, you're in the right place. For years, Quicken was the name in personal finance software. But let's accept reality – Quicken is often broken. It doesn't sync your accounts problem, you have password problems, screens that should appear are blank, and it's just not a great experience. Sometimes it feels like they're just getting you to buy the newer version, right? Quicken was once the most popular and powerful personal finance management software out there. But Quicken isn't what it used to be.

- Quicken Financial Life For Machines

- Financial Software For Mac

- Quicken Financial Life For Mac Download

It's hard to innovate a platform built in 1983. Back then, cell phones were bricks (if you could afford one) and apps were what you ordered at a restaurant. Quicken has faced a lot of technical issues and its support is meh at best. (if you own Quicken for Mac, you know this headache first hand) In 2010, Intuit acquired Mint for $170 million. In 2016, Intuit sold Quicken to private equity firm H.I.G. Look: If you're tired of Quicken, its support and sync issues, and want a suitable free alternative or replacement – we have some options.

Here are some of the best Quicken alternatives available: Our Best Picks. If you're quitting Quicken and want to move to a spreadsheet you can customize to exactly what you need, Tiller will automate all the data collection for you. You build a spreadsheet (or use a template) and Tiller will pull the data for you. Thus, saving you a ton of time and hassle. 11 Best Quicken Alternatives:.

– free financial dashboard and wealth planner. – spreadsheet automation to bring it in house. – best in class budgeting tool & mindset. – ad-supported budgeting tool. – compare your situation with your peers. – can import data from Quicken.

– not cloud-based. – follows Dave Ramsey's Baby Steps. – follows envelope budgeting method. – open-source and free. – date & calendar based budgeting 1. If you're a long time user of Quicken, you're beyond the “help me build my budget” phase.

If you're more interested how your investment account is performing and less interested in just knowing how much you're spending on groceries, Personal Capital is a great Quicken alternative (but it'll also pull your credit card transactions so you will know how much you spent on groceries if you want!). Personal Capital is a full-featured, free, personal finance management tool that focuses on helping you with investing. It has a powerful mobile app (also means it's a cloud-based service) that replicates the web experience. They're free because some users pay them for their wealth management services (optional). They are not stuffed with advertisements like some other free tools.

You can read my. Why it is a good alternative to Quicken: It's better than Quicken because it's updated, has a rich set of tools for investment and retirement, and it has a budget and expense tracking component. It's a website and not a software application, there's no software to download and patch or update (ugh) – that's all done automatically.

I am a fan of their retirement planner, a tool that helps you project your future financial needs and whether you'll get there. It's worth checking out. One other vote of confidence for this Quicken replacement is their CEO – Bill Harris. He was formerly the CEO of Intuit and PayPal. You know he has the leadership skills to dominate in this space and the ability to lead teams to build financial systems that are top notch (the rest of the leadership team is very impressive in their own right!). What could be better?

The budget and expense tracking are good but it's not as old as Quicken, so it's not as developed as Quicken. I don't find it to be a negative because it works for me, but people with really complicated budgets may find it limiting. Here's a brief over view video of Personal Capital's cash flow and budgeting tools. (since you access it with a browser, it is compatible with Mac OS!) 2. One of the most popular personal finance tools out there is a little software application known as Microsoft Excel. People love spreadsheets. You can customize it, tweak it, and get it tailored to exactly what you need.

The only downside to spreadsheets is how you need to pull the data yourself and who really wants to do that? Quicken was great back in the day when there weren't nearly as many sync issues because it pulled the data for you. There's a solution: Welcome – a $4.92 a month service (after a free 30 day trial) – that pulls your data for you and puts it into a Google Sheets or Microsoft Excel document. You can start with one of their free templates or build your own, but after the initial work you'll have a fully automated spreadsheet tailored to what you need. You can use this to track your net worth, set a budget, or anything else you can imagine.

Why it is better than Quicken: Quicken is now cloud-based so if you want to avoid putting your data into the cloud, going with a spreadsheet is your best option. Tiller makes it possible for you to get automation AND keep your data locally. Is one of the best budgeting software tools available. Think of it like Mint with a personality and a philosophy. YNAB's philosophy revolves around four rules:. Give Every Dollar a Job. Embrace Your True Expenses.

Roll With The Punches. Age Your Money Those four pillars form the foundation for a budgeting app that has helped many people transform their financial lives. If you're looking to transition to a financial tool that will help you (as in help you make the change, not just record expenses), you should take a look at. YNAB made a video showcasing the newest version plus a discussion on their philosophy. Why it is better than Quicken: Quicken only tracks your budget, YNAB does that AND helps you build a budget that meets the demands of your life and your savings needs. If you want to change the way you budget, while still tracking it, YNAB is your solution. YNAB is not an entire personal finance management suite – it focuses on budgeting and only budgeting.

You won't get investment tools, retirement planning, or wealth management. It's strictly about building, maintaining, and transitioning into the budget you want. You might have heard of these guys since they're now owned by the same company that once made Quicken. Intuit acquired them in 2010 and that's the reason why they shuttered Quicken Online shortly thereafter.

Later, Intuit sold Quicken to H.I.G. Capital and that's when you knew the end was near! Why it is a good alternative to Quicken: Mint is free and very powerful on the budgeting and expense tracking side. They do not have much to help you with investment and retirement savings, which I think you'll find is a huge limitation as you get older. The goal of Mint was always to be a budgeting app and with that in mind, they do a very good job. If you are sick of Quicken and focus entirely on expense tracking, Mint is a good Quicken alternative.

It, like, is cloud-based so there's no software to download, patch, or update. If you have investments and want to manage those, Mint will not be able to adequately fulfill your needs. Status Money is a free cloud-based budgeting tool that lets you compare your finances with people around the United States. It offers all of the tracking functionality of these other tools, will always be free, but adds the comparison component so you can see how you are performing against your peers and against the National Average. Your peer groups are set by your age range, income range, location (location type), credit score range, and housing status (own, rent).

This ensures you are getting a true apples to apples comparison and you aren't compared with someone in another age group, different cost of living, or life phase. You can also build custom groups too if you feel you're in a special situation not captured by basic demographic information. CountAbout The founders built CountAbout to be a Quicken alternative. Founded in mid-2012, it is one of the only personal finance apps that will import data from Quicken (and Mint!). If you're looking to transition away from Quicken but worry about losing all your data, you can feed it your Quicken file and it'll populate itself.

That'll make the transition far less painful! Like Quicken, CountAbout isn't free but it costs $9.99 for the Basic subscription and $39.99 for Premium subscription. The Premium subscription includes automatic transaction download.

A subscription model means you have complete data privacy and you won't get annoying ads like with Mint. Why is it a good alternative to Quicken? CountAbout has a lot of similar features to Quicken’s: split transactions, recurring transactions, attachments, budgeting and more. CountAbout is web-based, with multi-factor account security, so you don't have to download a program onto your computer, and there's no need to deal with unwieldy syncing issues – all you need is a web browser. And with CountAbout’s iOS and Android apps, your financial information is always at your fingertips.

Check out the key features (reminds me a lot of Quicken). Individual Account QIF importing. Budgeting. Running register balances. Account reconciliation.

Graphs for Income & Spending. Recurring transactions.

Investment balances by Institution. Memorized transactions. Split transactions. Description renaming. Invoicing 7. MoneyDance is not as well known as some of the other alternatives I've listed but I wanted to mention them because they're one of the few money apps that doesn't rely on the cloud.

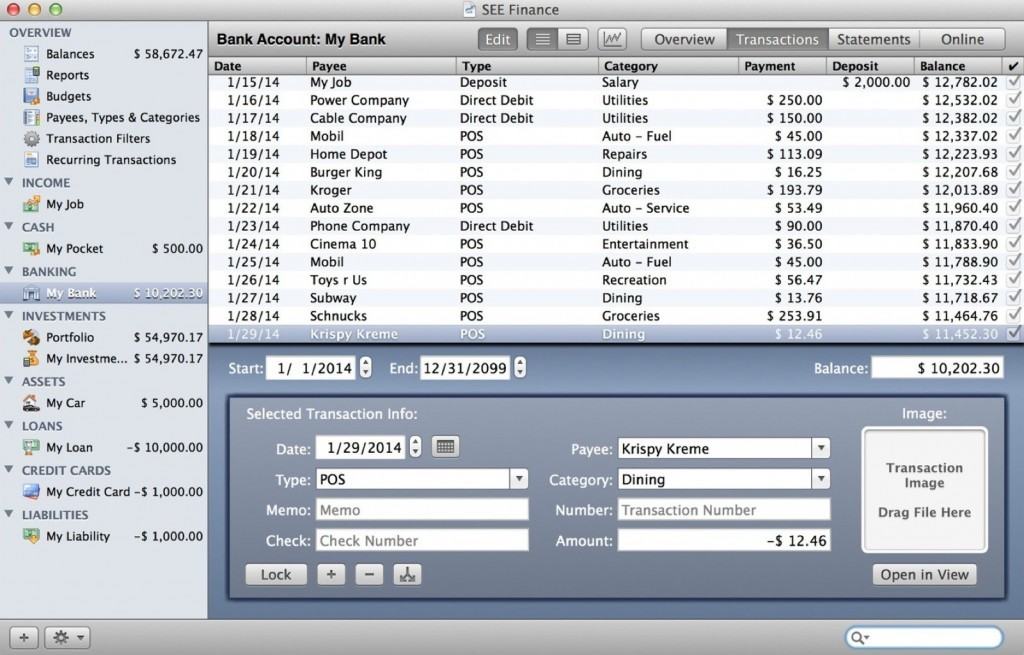

If you are concerned about your data being stored online, this solution is an alternative that keeps your data local to your computer. You can still link your accounts online, so they pull your transactions in automatically, but they only store them on your computer. You can enter transactions manually if you didn't want to link your accounts. MoneyDance looks and feels like a checkbook, with the check register for transactions, but has charts and tables for reporting. It does budgeting but can also as well, albeit not as feature rich as others. MoneyDance is free to download and try but it costs $49.99.

The free version has all the features as the paid version. The free version's limitation is that you can only enter 100 manual transactions. Have you heard of Dave Ramsey? Many folks swear by his approach and is built with that in mind. His approach takes into account human psychology, rather than relying solely on math, and explains why it is so effective. It also explains why ideas like the debt snowball work so well, we need to work with our biases and tendences if we hope to succeed. EveryDollar is a budgeting tool affiliated with Dave Ramsey's group, the Lampo Group.

Much like YNAB, it's a budgeting tool that uses the principles of zero-based budgeting. In zero-based budgeting, you assign every dollar to a category (or job, in YNAB parlance). It's a level of rigor that can be refreshing or restricting, depending on your personality.

The app itself is beautiful, available on your smartphone, and there is both a free and paid version. The paid version costs $99 a year. (paid version offers phone support and automated transaction importing which is a big time saver; otherwise, you must manually enter the data) Here's a tutorial video on how to build a budget. GoodBudget is a free budgeting app based on the envelope budgeting method. Envelope budgeting is when you set aside a prescribed amount for each category of spending, then spend it down each month. It's one of the most popular money management techniques in personal finance.

The envelope refers to the manual method of managing these types of budgets where you put the money into an envelope. When you run out of money, you either borrow cash from another envelope or you make do. GoodBudget adds technology to the mix and will synch up bank accounts to help track your income and your spending. You set the amount for each category and then watch as your spending nears the limit each month. It's available for both iOS and Android phones. GnuCash is a free open-source accounting software that, if you're willing to put into the work, can replicate a lot of the Quicken experience for those who are willing to scale the learning curve.

It features double-entry accounting (every transaction must debit one account and credit another), which is effective but will require an adjustment if you're not used to it. It offers a lot of the functionality of Quicken like splitting transactions, categorizing transactions, managing multiple accounts, schedule transactions, and reporting that includes all kinds of charts and reports (balance sheet, P&L, portfolio valuation, etc). The big benefit is that it does budgeting as well as investments. It's not strictly a budgeting tool. Lastly, it offers QIF importing, so you can import your Quicken files, plus OFX (Open Financial Exchange) protocol. So you can pull in your data if your bank offers you the ability to export transactions.

Dollarbird is another personal finance app with an eye towards collaboration and a monthly calendar. You synchronize your accounts (banking, brokerage, and credit cards) with Dollarbird and they build a schedule of future income and expenditures to help with planning.

Dollarbird also offers a 5-year financial plan that lets you establish longer-term financial goals and track your performance against them. The innovation they bring to the table is the idea of calendar-based money management. You can collaborate with other people (partner, family, or a team) to manage a team budget, though the collaborative piece requires the Pro version ($39.99 / year). One of these will make a fine replacement for Quicken.

Is there a Quicken Online? Intuit created Quicken Online to try to compete with Mint. Near the end of 2009, they gave up and acquired Mint. Afterward, they opted to shut down Quicken Online and sold the entire Quicken unit to H.I.G. Capital in 2016.

Quicken Online no longer exists. Quicken does have an online experience, something they've only recently created, but it's not free and it's playing catch up. Why is budgeting so important?

A lot of folks start using Quicken to help them maintain a budget. As the tool started having problems, you may be tempted to quit altogether. We wanted to briefly discuss why budgeting, whether with Quicken or one of these other alternatives, is a good idea. For that, we turned to: 1. Why do you believe it is important for individuals to budget? Professor Ariel Belasen, Associate Professor of Economics and Finance at Southern Illinois University EdwardsvilleWith credit card spending superseding cash spending as the predominant form of payment, it’s especially important for people to budget because it’s tougher to experience the “slim wallet feel” of spending.

Instead, the impact of spending hits all at once on each credit card statement. That means overspending is far more likely – and far more costly given that credit card interest rates are on the rise again. Many folks think of budgeting as tracking what you've spent, how do forecasting and planning fit into budgeting? Most people spend more on fixed expenses each month than on variable expenses.

Fixed expenses are your mortgage or rent, utility bills, phone and internet bills, daycare expenses, etc. The largest variable expenses are typically food and transportation. Planning a month or two ahead will not only help you keep track of what you have already spent, but it will give you an idea of what you can spend moving ahead. It’s also important for people who enjoy taking a vacation or who want to make a large purchase in the future. Planning ahead can help an individual figure out how much disposable income should be saved each month. Personally, how do you budget and how has that changed over the years?

I use Microsoft Excel and I plan a quarterly budget which, at this point, revolves around my childcare expenses. But prior to having children I used to budget out one month in advance so that I could be sure to allocate a certain amount to savings. I find it easiest to put together a simple balance sheet listing when paychecks come in and when various bills or direct debits will come due. If you were advising a student or recent graduate on budgeting, how would you suggest they get started? First of all, I’d recommend calling their credit card company to place a hard cap on their spending limit (preferably well below the overall card limit) so they do not exceed a fixed amount of spending or incur penalties for exceeding their card limit. Once that preventative step is taken, the rest involves keeping track of due dates for bills and deposit dates for paychecks. I would recommend just looking at the current month at first and then eventually expanding out to the month ahead as well.

Saving is far less important for students since their income will rise quite a bit after graduation, but falling into default on their personal debt can haunt them for years. Jim Wang is a thirty-something father of three who has been featured in the New York Times, Baltimore Sun, Entrepreneur, and Marketplace Money. Jim has a B.S. In Computer Science and Economics from Carnegie Mellon University, an M.S. In Information Technology - Software Engineering from Carnegie Mellon University, as well as a Masters in Business Administration from Johns Hopkins University. One of his favorite tools is, which enables him to manage his finances in just 15-minutes each month.

If you sign up and link up an investment account with $1,000+ within 40 days, you get a $20 Amazon gift card. They also offer financial planning, such as a Retirement Planning Tool that can tell you if you're on track to retire when you want. He is also diversifying his investment portfolio by adding a little bit of real estate.

But not rental homes, because he doesn't want a second job, it's diversified small investments in a mix of properties through. Worth a look and he's already made investments that have performed according to plan.

An important point about CountAbout is that the $9.99 or $39.99 is per year! That’s pricey, even surpassing Quicken for all but the simplest of accounts. I prefer a one-time fee rather than the constant reach into my wallet. I chose Ace Money which is a very good substitute for Quicken on a PC (the Mac version runs via an emulator. Hopeless and looks like a DOS program).

As I recall it was something like $60 one time and syncs most accounts pretty well. MoneyDance I found very simple and a poor substitute. I’m happy with the switch to Ace money and have moved on from Quicken. I have used Quicken for many years, ever since Microsoft Money was discontinued. It used to be great but today it is fraught with errors that cause me to spend more time trying to figure out what is wrong with the application and sync than I spend managing my spending and investments. I really do not want a cloud-based application. Call me old school but like have all of my information on my personal computer or in my file cabinets.

Really ready for a STABLE alternative that can download my CC and investment transaction and reconcile correctly. Kind of like Quicken used to be?

I have been a Quicken Home & Business user for many years, in the US and more recently in Canada. The Canadian operation has now moved to a subscription mode and the Home & Business version now has an annual subscription fee of $90 per year – to me, that’s a real ripoff. To discourage you from continuing to use your current, non-subscription version, they have now disabled two key features – downloading & categorizing transactions from financial institutions and downloading stock quotes.

I have tried all the major alternatives out there, and my favorite by far is one I rarely see mentioned – KDE’s KMyMoney. Just tried MoneyDance and CountAbout – the two closest things to what I’m looking for – and found them worse than even Quicken for the features I really care about. I just want an easy to use electronic register I can enter transactions into for all my accounts then reconcile against statements as they come in. Not much to ask. And I think just about EVERYONE I know wants one too. We all hate Intuit software but are reluctantly using it because nothing else out there does the two things Intuit does reasonably well: Easy, rapid transaction entry and account reconciliation.

Of course, lately it seems that Quicken is just getting worse with each new release. Bugs creep in and are never fixed. I think maybe it’s time to just write my own solution and get insanely rich off it. There’s a huge market out there for an easy to use electronic register.

Can’t understand why nobody is jumping on it to knock Intuit off that hill they occupy all by themselves. For several years I used MoneyCounts a very simple program but it was bought out and ended up being discarded by Intuit and users advised to use Quicken. I to want a simple program that will keep an electronic register on multiple bank accounts and capable of downloading bank transactions that is not cloud based. Some of the newer programs will do a wonderful job of budgeting but will not give a decent P&L or Income & Expense report that is helpful for the preparation of one’s tax reports. I tried Moneydance but could never link it to download transactions from any of my banks in mid-America.

Would someone please come up with a simple accounting program. While not being a budgeting program per say if it had the capability of doing fund accounting an individual could allocate their income to the various funds and be directly subtracted when the expenditure account (whether called a Category of account is set up to come from a given fund) is posted to in the register. I used Quicken 2007 for home and business (Windows version) for 10 years. Tried the upgrade to 2011 but went back to 2007 version as new features were just complications. Now we have switched to Mac computers and bought 2017 Quicken for Mac.

Hugely disappointed, can’t even print a reconciliation statement along with the illogical interfaces. Much more complicated than the Windows versions I’m used to. I agree with the comment above. We need a simple way to keep our basic financial accounts and good reminders when bills come due. A good “simple” old fashioned system really would sell to most of us. Just the essentials please!!

Quicken is the best known personal finance software. Best is it the best? We put it to the test in our Quicken 2019 Review. Here, we’ll walk through the general pros and cons of Quicken, who its best for, costs, new features, add-ons and a walk-through of features for Quicken 2019.

Is one of the big names in the world of personal finance, partially because it’s been around for so long. Quicken was first released in 1983. Its first version ran on DOS! So it’s something of a dinosaur among budgeting apps. With that said, Quicken still has a lot going for it, though it’s not the right financial management tool for everyone. Pros and Cons of Quicken With a tool that’s been around since the 80’s, there’s a lot to love and a lot to dislike. Quicken definitely has its quirks, and it’s not a great fit for everyone.

But it also has some great things that long-time users absolutely love. Here’s a quick list of pros and cons to consider. Quicken Pros. Doesn’t have to sync directly with your bank. If you don’t like the idea of a budgeting tool connecting directly with your bank accounts, Quicken doesn’t have to.

Quicken Financial Life For Machines

But you can also manually enter transactions. Or you can download a Quicken or CSV file of transactions from your bank. Then you can upload them to Quicken in just a few seconds. Easy-to-use visuals. I don’t find Quicken’s visuals to be the most appealing in the world of budgeting tools. But they’re not terrible.

You can get a quick breakdown of where you are on your monthly budget categories, where you spend most of your money, and more. Total control over both budget and investment data. Many other tools, such as Mint and Personal Capital, are more focused on either budgeting (Mint) or investing (Personal Capital).

With the right version of Quicken, you can get a robust management option for both. Debt reduction tools built in. Quicken has built-in tools for reducing your debt. It will let you project out the impact of extra debt payments, including how much you’ll save in interest. Bill tracking and reminders.

You probably already from many of your credit card and utilities companies. But you can move them all into the same interface with Quicken. It will also help you find your bills when you set up your account. Projected balances based on upcoming bills. One of the cool things about putting in your bills with Quicken is that it lets you figure out how much money you will have in the future, based on your upcoming bills. Automatic net worth tracking.

If tracking your net worth is important to you (and it!), Quicken makes it easy. You’ll actually get a net worth calculation on the sidebar that changes any time you make changes or import new transactions.

Mobile app with alerts. Quicken also offers a mobile app. It’s not the slickest one in the bunch. But it will let you enter transactions and check out your accounts on the go. Quicken Cons. Relatively high costs compared with some tools.

Quicken is to Intuit’s free tool,. It’s basically a more robust version. But it costs anywhere from $40 to $80+ per year, depending on which version you buy and whether or not you get a discount.

Doesn’t sync with all banks easily. I had trouble syncing Quicken with my Huntington National Bank checking account. I’ve had trouble with Huntington with other tools, as well, just for full disclosure. But the problem with Quicken is that you have to purchase it before you can try to sync it with an account. So you may want to dig around online to be sure it’ll work with your bank if syncing transactions is important to you. Can be overwhelming to begin using. Probably the biggest issue for new Quicken users is sheer overwhelm.

It includes a lot of different tools and information. Getting it set up can take a while, and learning to use it efficiently can take even longer. If you want a full picture of your finances, this can be worth your time. But if you just want to spend ten minutes a week tracking your budget, it’s probably not your best bet. Not as smooth as some interfaces. Quicken has always left something to be desired with its interface, I think. It’s just not as pretty or as intuitive as some budget tool interfaces.

With that said, it’s gotten better since I first started reviewing it. It’s cleaner and more intuitive now than it used to be. Not available on the cloud. Perhaps the biggest drawback for me as an on-the-go Millennial with several different devices is that Quicken has to be installed on my computer. So I can only fully access it in one place, unless I install the software on multiple computers. This can get frustrating. Frankly, I’d rather use a tool I can access from anywhere with an internet connection.

With that said, it could be nice that you don’t have to be connected to the internet to perform some tasks on Quicken. Who is Quicken For? Now that you know the basic pros and cons of Quicken, you might already have figured out whether or not it’s for you.

But here are some people I think might benefit most from Quicken. The Detail-Oriented If you really want visibility into every aspect of your financial life all in one place, Quicken may be the best tool for you. Yes, other budget and have similar functions. But few have the available tools for debt payoff, balance projections, and long-term planning that Quicken offers.

Financial Software For Mac

As a detail-oriented person, you may be likely to spend time digging into what Quicken offers. And this may make it worth your while. Once you get your systems in place and start using this tool, it will provide you with details on the minutia of your entire financial life.

Business Owners Of course, Quicken is still a go-to for business owners. Even larger businesses and nonprofits use their robust tools for managing the business budget. But I think it’s the ideal tool for small business owners and entrepreneurs. That’s because it can simultaneously track your business finances and your personal finances.

Quicken Financial Life For Mac Download

It’ll keep things separate for you, but you can use the same tool to do both. And that could save you time and headache in the long term.

Investors who Budget As I’ve mentioned before in this review, many other tools focus on either investing or budgeting. Is an excellent tool if you want a detailed view of your investments and a sky-level view of your spending. You can certainly use it for a more detailed budget, but it’s not built for that as much. Mint, on the other hand, will track your investments.

But it gives you a detailed budget and an overview of your investments. Quicken combines detailed budgeting and detailed investing, so that you get both in one tool. So if you’re an investor but you also prefer to operate with a detailed budget, Quicken might be the tool for you. Those With Security Concerns Increasingly, budgeting and investing tools sync directly with bank and investment accounts and store data in the cloud. Quicken can be set up to do neither. It can live exclusively on your desktop.

And you can pull in data manually or with downloaded transaction logs from your bank. If you’re concerned about the security of other systems, Quicken can give you the financial management tools you need while allaying some of your security concerns. Quicken 2018 Features Quicken comes out with a new version each year. You can upgrade your older version, or you can just get started with the latest version. Here’s what you’ll find with Quicken 2018. New Features and Costs for 2018 One of the biggest is Quicken’s expanded Mac options.

For the first time, Mac users can decide between different products based on what suits their needs. Overall, Quicken is supposed to just work better for Macs than it has in the past. Here are a couple of other new features:. Membership Based Program: Instead of purchasing an upgrade every year, Quicken members pay an annual fee and automatically get upgraded each time a new version rolls out. Online Billing Access: Quicken now integrates with more than 11,000 billers, and it lets you download PDF copies of your bills right to Quicken. You can even track and pay bills from Quicken. Direct Report to Excel: If you want to track your budget and financial performance over time in Excel, Quicken can now directly export reports to this program.

Better Investment Analysis: This feature is constantly being improved, and it’s supposed to be even better for 2018. Dropbox Partnership: All new users will get an extra 5GB of data from Dropbox to back up their Quicken data. Those are the new and updated features you can expect with the latest version of Quicken. So what does it actually look like and do?

I imported a few weeks’ worth of transactions to give you a quick walk-through of the latest interface. Home The first tab on your Quicken interface is the Home tab. This gives you a quick summary of your current financial situation.

The good news is that you can customize this screen. You can show your spending first or prioritize your investments.

It’s completely up to you. When you start up Quicken, the home screen will give you different quick-start options, as you’ll see below. You can see that Quicken wants me to set up my bills in the system. And as you’re getting started, you can use the built-in wizards to walk through these processes step by step. The Customize button lets you choose exactly what appears on your home screen and in what order: From the Home screen and every other screen, you’ll see the navigation bar on the top and one on the left. The bar on the left includes your current net worth at the bottom.

Spending The second tab is where you’ll go to track your spending. Quicken will automatically break down imported transactions into categories. But you can always recategorize transactions. You can also change the categories here, depending on how your budget breaks down. One of the nice things about this screen is that you can look at spending in different chunks. The drop-down menus at the top let you look at spending only from certain accounts, or from certain periods of time. So you can see what categories you spend on from your checking account versus your credit card, for instance.

Keep in mind that this data could be totally inaccurate as it comes in. Quicken will alert you when there are uncategorized transactions. But you may want to double-check the categories of every transaction as it imports. Sometimes Quicken just guesses wrong, which can throw your percentages way off.

Bills and Income This is probably the feature I like best about Quicken versus other budgeting options. You can sync it up with your billers, such as Verizon or AT&T.

It takes some time to sync up with all your bills. But once you do, Quicken will put them into a calendar view. Then it’ll tell you what your account balances should be based on your upcoming bills. You can do the same thing with planned income.

If you have a salaried job with regular paychecks, tell the system when you’ll get paid and how much. Again, it uses this data to project out your account balances. If you’d rather, or if your bill provider isn’t available, you can put in your bills manually. I can, for instance, put in how much we need to pay for daycare and when that’s due each month. Again, these future bills will show up on your calendar, and you’ll get a projected account balance based on your bills. I had to fiddle around with this interface for a bit before I could figure out how to use it properly.

But once you have it, syncing up your bills shouldn’t take all that long. It’s just a matter of making sure you put them all in so that your projected balance isn’t too far off. Once you put the bills in, you can mark them as paid as they get paid off.

This will happen automatically if you’re synced to the biller. Financial Planning Quicken’s robust financial planning tool includes several options, such as budgeting, tax planning, and long-term planning. I dug into the budgeting tool with Quicken. As with the rest of the software, this wasn’t the most intuitive budget builder I’ve ever used. You have to first create the budget and then use the “Budget Actions” tab to decide which categories to add. But they offer a bunch of categories, so you can create quite a detailed budget. Once you add the categories, you have to edit them individually to change their amounts.

It’s really kind of a pain. But here’s something I do like: you can decide at the beginning of the year how much to budget each month for each category. If you like planning way ahead, this is a great option. Not many online budgeting tools will let you plan an annual budget or plan so far into the future.

Quicken also includes on this tab is Debt Reduction calculator. This lets you keep track of your current debts and create a plan to pay them off. It helps you project out how much you need to pay towards your debts to get them paid off, and it’ll show you how much interest you can expect to pay over time. The Savings Goals tab allows you to do the same thing except for savings. You can save for specific goals, such as an upcoming vacation or a new car.

This section is meant for short- and mid-term goals. The investment tracking option is more for long-term goals like retirement and overall financial freedom. Quicken also offers a Tax Center. You can input your tax information, and it will tell you your projected tax return or taxes due.

You can also assign expenses to various tax categories. This is helpful if you’re a small business owner or if you run a side gig with tax-deductible expenses. You can also use it to track things like charitable donations. The Lifetime Planner tool is, as you might guess, a big overview of your entire financial life. You have to first answer several questions, and then Quicken helps you project your finances out over years and decades. It’s a high-level tool that can be helpful for gaining some additional insight into your financial life. Add-Ons If you’re already using Quicken, you should consider adding on some of its additional services.

The most worthwhile are probably the bill paying services. This service is free for Premier and above users, or it costs $9.95 per month for others. It lets you pay your bills directly through Quicken. This can just make staying on top of your bills simpler.

Other services to consider include Quicken’s Social Security Optimizer and their premium support for Windows users. There may be other tools online that can replace these, though, so be sure you do your shopping around. You can also purchase the Quicken WillMaker tool through the program. I’ve reviewed this elsewhere and think it’s a reasonable service for those with simple wills. Other Features Probably the best newer feature for Quicken is the ability to set up mobile accounts and get alerts.

You can set up alerts for different account changes or upcoming bills, for instance. Most bank and investment accounts these days also let you set up alerts. But putting them all in one place might be helpful as you organize your financial life. And, of course, provides lots of documentation and tutorials. It’s one of the longest-running financial management tools around. So you’d expect it to have plenty to say about how to manage your finances. In the “Tips & Tutorials” section, you can get information on Quicken, specifically, or broader information on getting out debt, setting savings goals, and more.

Not sure if Quicken is right for you? Check out these.

Chuck Quickens new policy of requiring a yearly membership is a big ripoff for consumers. I used to be able to decide when I wanted to upgrade my current version of Quicken based on enhancements and features that were updated each year. Most of the time, I chose to upgrade every other year.just to stay current. Now they require you to upgrade every year or they turn off their banking and investment download feature.meaning you have to manually download your information from your bank(s). Quicken has decided that more money takes precedent over making personal finances easier. I will be looking at other software options.

Jack Feder I have used this product for a couple of decades. They have added features, but changed the functionality a little. I can not switch as my data is captive, but after a recent upgrade, there were a few corruptions to my DATA! The opening balances were changed by the upgrade process. This is not acceptable and I only found out about it when I could no longer balance my accounts. Accounting software the corrupts data is less than worthless. Also, when I had problems with the automatic connection features, support wasted a day by being useless, telling me I had to reinstall everything etc.

In the end, after escalation, it turned out they said they had trouble communication with some institutions, but they did not even notify their support people and the setup wizard is poorly written so you can’t tell. Now, I am trying to set up the upgraded version so that it can print cheques. Do you know that in the format if you select “blank line before payee” that it no longer prints the adress of the payee? If you get rid of the blank line, the adress prints, even though the adress is only 3 lines and does not fill up the box. Based upon my previous dealings with their tech support, I won’t even bother notifying the. I can’t waste the day. It is better just to warn people about this product.

Steve Antonoff I’ve been using Quicken for almost 30 years (Quicken for DOS starting in 1989, before Windows). My habit, up until now, was to upgrade every other year since financial institution interfaces lasted for 3 years with each upgrade. I’m going to wait until 2019 comes out before I upgrade, and then I’m going to take a look at other programs before I commit to an annual purchase for an unreliable product.

To me, the biggest issue with Quicken is the “fragile” data base. I admit I haven’t cleaned out my Quicken file in about 12 years now (accounts have data going back to 2006) so I’m probably stressing the file more than I should. But a fully functional financial program should use an SQL database with new tables for each year (or fiscal year). An annual closeout, that closes the previous year and starts a new one, should happen automatically on the first entry for the new (fiscal) year. I had a situation recently where I withdrew a large chunk of money from a Savings Goal.

The withdrawal from the goal worked but Quicken must have crashed before it put the money into the originating account, leaving me $thousands short of cash until I found the error. Recently (starting in July), Quicken started duplicating some downloaded transactions in multiple accounts: I have 4 accounts with my investment broker and when a dividend was received in 1 account, Quicken put it in 2 others, even though those accounts didn’t have any of the stock that was paying the dividend. I discovered this in August through a reconcile process that wouldn’t balance: Quicken had $hundreds of “bogus” transactions that had to be manually deleted. I don’t know if this was the fault of Quicken or the financial institution. I now verify my Quicken file at least monthly to find and eliminate errors.